Independent Evidence Records for Tax Case Work

Verified Proof produces time-stamped evidence records that document work performed within a defined scope — independent of IRS decisions or outcomes.

Purpose Statement

Why This Exists

Tax case work often breaks down not because of intent, but because evidence is incomplete, unstructured, or disputed. Verified Proof exists to make work legible—to firms, clients, regulators, and third parties—through standardized evidence records.

Unlike tax or accounting software, evidence records are created independently of any specific tool or method. Every record uses clear, consistent structure to document how work was performed, regardless of outcome.

This is not verification of correctness. This is documentation of process—what was done, when it was done, by whom, and where the underlying evidence exists.

Process Overview

How It Works

Define

Establish case identity, scope, and categories of work to be documented. Scope is confirmed before evidence intake begins.

Intake

Collect documentary evidence organized by category. All evidence is timestamped and cataloged.

Review

Evidence is evaluated for presence, completeness, and consistency against the defined scope.

Issue

An immutable Evidence Record is generated with timestamps, scope documentation, and evidence status.

Rely

The issued record can be shared with clients, third parties, and regulators without interpretation.

Scope & Limitations

What We Do / Do Not Do

What We Do

- ✓Document scope of work performed

- ✓Review evidence presence and completeness

- ✓Issue immutable, time-stamped records

- ✓Identify gaps and limitations explicitly

- ✓Maintain audit-grade activity logs

- ✓Provide neutral, third-party documentation

What We Do Not Do

- ×Verify IRS outcomes or acceptance

- ×Provide tax or legal advice

- ×Guarantee results or correctness

- ×Replace firm judgment or liability

- ×Act as an IRS intermediary

- ×Evaluate strategy or compliance

This section must be explicit and unambiguous. Verified Proof documents evidence of work performed. It does not verify outcomes, provide advice, or replace professional judgment.

System of Record

The Evidence Record

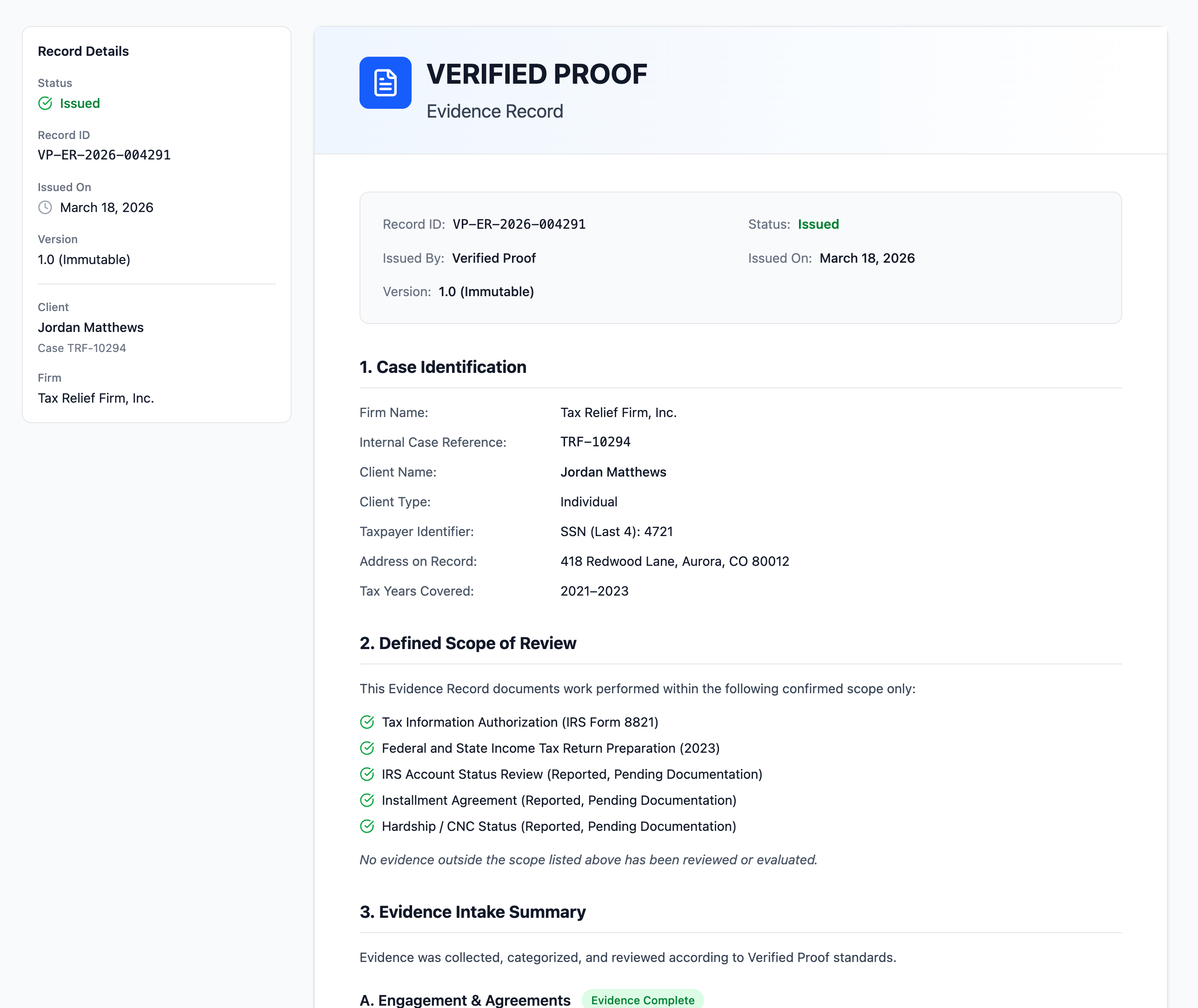

The Evidence Record is a formal artifact documenting work performed within a defined scope. It is immutable, versioned, and designed for external reliance.

Each record includes case identification, a confirmed scope of review, evidence status by category, factual summaries of evidence reviewed, explicit documentation of gaps or limitations, and a time-stamped activity log.

The record is generated as a PDF and can be shared with clients, regulators, auditors, and third parties without interpretation or advocacy.

This is a system of record, not a report. The Evidence Record does not evaluate correctness, provide advice, or guarantee outcomes. It documents what evidence existed at the time of issuance.

Target Users

Who This Is For

Tax Relief Firms

Firms handling high-volume tax case work that require standardized documentation of evidence and scope for each case.

Accounting & Compliance Teams

Internal teams managing evidence review, documentation standards, and third-party audits at scale.

High-Volume Case Operations

Operations processing hundreds of cases per month requiring consistent, defensible documentation of work performed.

Compliance & Auditability

Security & Integrity

Evidence records are designed to be defensible, durable, and auditable.

- •Evidence records are immutable and time-stamped

- •Records are stored chronologically with tamper-evident structure

- •Access is logged and restricted to authorized users

- •Data retention follows professional services standards

- •Records remain available for regeneration and audit